Market Commentary Q1 – 2016

You’re Hired, Here’s Your Phonebook. Not the Actual DOL Rulebook…But Close

Just sit here and mumble your first name, maybe they won’t know the difference.” It was the summer of 1976 and I had recently graduated from Guilford College and somehow landed a job as a stockbroker. This was an odd thing, since I knew neither what a stock nor a broker was. However, I did have one thing going for me: my last name. It just so happened that a very old stockbroker with the last name of Smith had just retired and my manager thought I could pick up his old “book of business” where he left off. So the calls began, “Hello it’s (mumble) Smith and I was wondering if you wanted to buy some shares of…”

This last week, the Department of Labor (DOL) announced a groundbreaking 1,000+ page rule that will impact about 21 million retirement plans and IRAs; hopefully in a positive way. The new rule will push stockbrokers and some financial advisors to start serving as fiduciaries (acting in their clients’ best interests) when dealing with retirement accounts. It is estimated to affect 60% of U.S. households, produce roughly 86 million new written disclosures, and cost the industry an additional $70 million in reporting costs alone.

Thankfully, nothing material will change for Smith Partners and our clients. We have been fortunate to be able to serve our clients as fiduciaries for the last 28 years. However, it was my first 10 years in the business that led us to be ahead of the curve. Back in the 1980s there was no online brokerage or easy way to buy investments. If you wanted to own 100 shares of a stock, you would need to call up a stockbroker to have them buy it for you…or worse, wait for them to call you. I have vivid memories in those first days of opening the phonebook and “dialing for dollars” as we tried to place stocks and bonds with potential investors.

The majority of our transactions went to investors with whom we had long-standing relationships, who knew the companies we were offering, and we charged commissions that were in line with industry standards. And while I have been out of that model for 28 years, it still took some time for me to realize what was missing in the transactional business: the client. We weren’t encouraged to fully understand a client’s risk tolerance or retirement goals. Never would I have thought to ask if a client had debt to pay off or charities to fund instead of buying this bond. That was highlighted one day when our manager gathered everyone around to tell us about the bond we would be selling that day. When I asked him what the bond was rated, in terms of credit quality of the company, he said, “you’ll get paid 5%, that’s what it’s rated.” The order of priority was clear: company first, then broker, and finally client. It didn’t take me long after that to establish Smith Partners Wealth Management as a fee-only Registered Investment Advisor putting clients’ best interests first.

Today there are fewer advisors who work on a purely commission driven basis (paid up front for a transaction), however that has not taken away the transactional nature of many advisor relationships and the potential for conflicts of interest that come along with it. The new rule draws a distinct line from the old Suitability Standard (an investment must be suitable for a client) and now strongly encourages the Fiduciary Standard (the investment, and the decision to invest at all, must be in the best interest of the client).

Years ago, we were heading on a long car trip, so I took my Suburban in to replace its noisy tires beforehand. It wasn’t going to be a cheap bill, but I was sure I needed to do it. Of course, I had been conditioned to expect upsells, hidden costs, and “unforeseen” problems from mechanics. So imagine my surprise when the mechanic said I could actually get another 20,000 miles out of my tires. I didn’t connect the dots until later, but I had just experienced a fiduciary mechanic. He tangibly put my interest ahead of the shop’s and his own. It was even more obvious because the “suitable” thing to do would have been to sell me the tires I requested. However he sent me away with a couple of wiper blades, an oil change, and a restored confidence. This is the kind of relationship the DOL is trying to put in place in the retirement arena. We see potential good and “not so good” outcomes of the new rule and, as we typically learn best from analogies, we put them in the context of the local tire shop.

The Good:

“Our profit margin for each tire will be reasonable and not dependent on which tire you buy” The heart of the DOL rule is to get to a point where advisors provide guidance with as few potential conflicts as possible. Although it solely addresses investing and touches very little on financial planning, the DOL’s push to remove excessive and disproportionate compensation is a great first step.

“It doesn’t have to be the single best or cheapest tire in the world” The brokerage industry’s biggest concern seemed to be the high cost (and lost revenue) associated with delivering anything below the single best or cheapest product/piece of advice. The final rule has allayed this fear by offering the directive for “prudent” rather than “best” advice; this is actually good. Had the rule hinged on “best” advice, the costs of compliance would have been unbearable and/or the industry would have fought the rule tooth and nail. As of now, no credible opposition to the rule is on the table.

“You could hear from OUR lawyer about your chain of stores and maybe about these tires” The new disclosure rules allow for an institution to have a class action lawsuit brought against them in the case of widespread lack of fiduciary compliance. This will result in firms proactively implementing policies and procedure changes, which will have positive effects for many investors before they have a reason to complain. However, it is very different from the power that most individual investors have afterward (see the first “Not So Good” below.)

The Not So Good:

“You will hear from my arbitrator about this specific set of tires” When the issue comes to individual investors, the investment company can still require (before the engagement starts) that any disputes go to an arbitrator. As Irwin Stein, a securities attorney with 40 years of FINRA experience noted, “FINRA arbitration claims settle about 80% of the time…In any settlement the firm pays less than the customer wanted and certainly less than the customer lost.” Stein also points out that when a client can use an attorney, the potential award would have to be large enough to warrant hiring an attorney (meaning losses of at least $100,000; not exactly your average investor.)

“We will act in your best interests…for most of your cars” The rules are only in place for retirement and education accounts, but not taxable accounts. While the rules could eventually apply to all types of investment accounts, for now we can only hope that institutions adopt fiduciary practices toward the client, regardless of account type.

“We can still sell you in-house tires that pay us more” As Stein notes, “the rules provide for an exception to [self-dealing] conflicts where the firm believes it is in the customer’s best interest…even if they get a higher commission.” Add to it that the potential downside of owning these inefficient investments could be too small to take to arbitration.

“Our promise is in the fine print…on the website” Whenever the institution does have conflicts, they must disclose them, but only on the firm’s website, not handed directly to the client on paper. This is again in contrast to the pledge firms like ours make in avoiding conflicts whenever possible not simply disclosing them.

“Yeah, sure, we’re all fiduciary mechanics” If a new rule came out that convinced me that more mechanics should put my interests first, I might have never found the really good mechanic. Or as fellow financial planner Carl Richards refers to them tongue in cheek as “the secret society of real financial planners.” We believe that being a fiduciary means telling a client to go pay off a mortgage if it not only makes financial sense but also (and sometime more so) if it makes behavioral sense. Being a fiduciary means not just talking about the costs of college, but the family’s philosophy about how much college (and for what GPA) they are willing to pay. Being a fiduciary means asking a client “when are you happiest?” and then working to incorporate that into the investments and the financial plan. However, any rule (and the accompanying paperwork, disclosures, and legalese) can create a false sense of security and could cheapen the definition of the kind of fiduciary advisors that investors need and deserve.

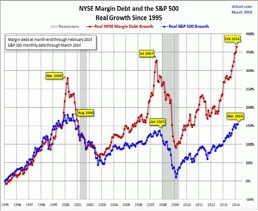

As Vanguard researched in 2014, a fee-conscious fiduciary advisor can have a 1-3% annual positive impact on a portfolio through behavioral coaching, rebalancing, asset location and other strategies. This new rule is a huge step in the right direction for the average investor. When it is finally implemented in 12-18 months, we will see far more advisors putting clients’ best interests higher on the priority list; something we firmly support.