Quarter in Charts – Q4 2023

Happy Adjacent

I recently learned the term “Happy Adjacent” when I stumbled on a YouTube series from Mythical Kitchen called “Last Meals.” The episodes center on Chef Josh Scherer asking famous people (some more famous than others) what they would eat for their last meal on Earth. Josh then recreates the meal, and they sit down to eat together. And while the smorgasbord of food is fascinating, I really love the conversations on meaningful topics like family, purpose, work, faith, and death.

While Tom Hanks feasts on his “last meal” (In-N-Out Burger, Challah French Toast with Sugar-Free Syrup, Diet Dr. Pepper, Greek Salad with Calamari, a sampler dish from his favorite Mexican restaurant, and coconut cake from Tom Cruise), he also talks about loneliness, how much he loves being with his family, generational trauma, and God. Talk about a heavy meal.

The last question Josh asks his guests is, “Are you happy?” and he gets a wide range of answers. Tom Hanks replied, “Uhh…I’m content. Happiness comes and goes. This too shall pass with happiness. Contentment can actually linger for a while.” Which I thought was a pretty great answer.

But the response that stuck with me was from Actor Josh Peck, who said, “I’m happy adjacent,” and he didn’t elaborate. I think “Happy Adjacent” is an excellent description of the current economy, investment returns, and even us as people.

Market Returns

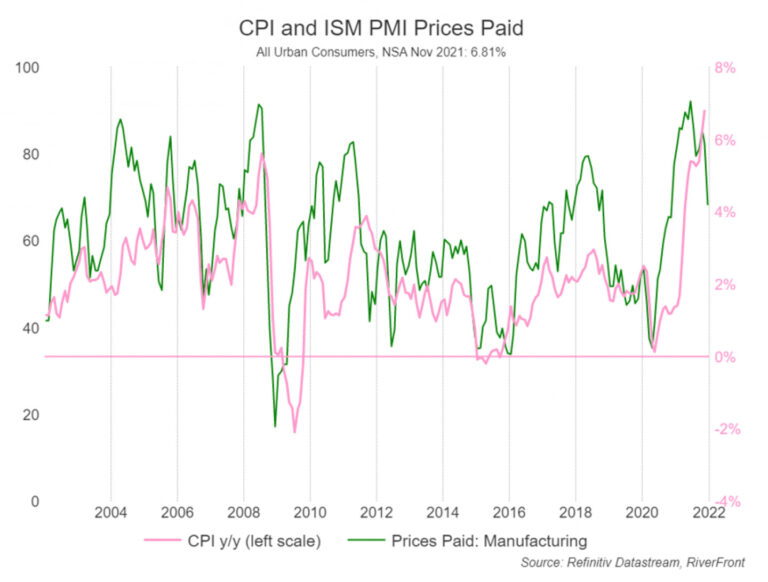

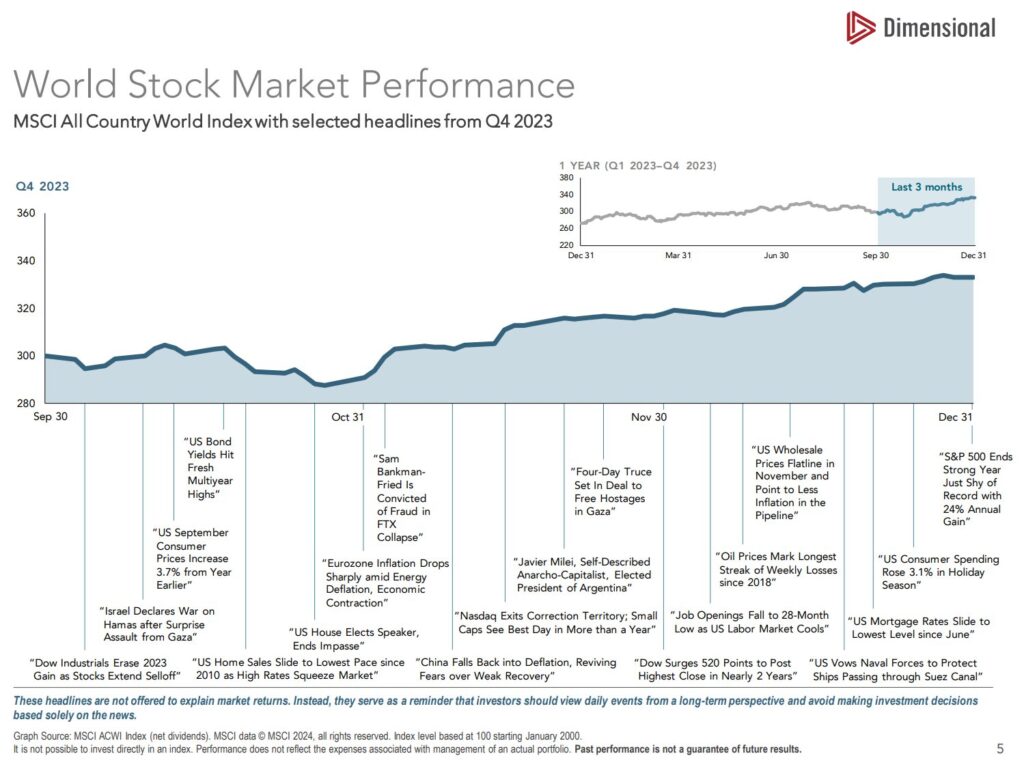

For the first ten months of the year (seen in the inset chart below,) global stock returns were good but didn’t take off until the final two months, when Mr. Market felt more optimistic about the future. Bonds finished the year positively due to slowing interest rate increases. The only major market category that declined was commodities.

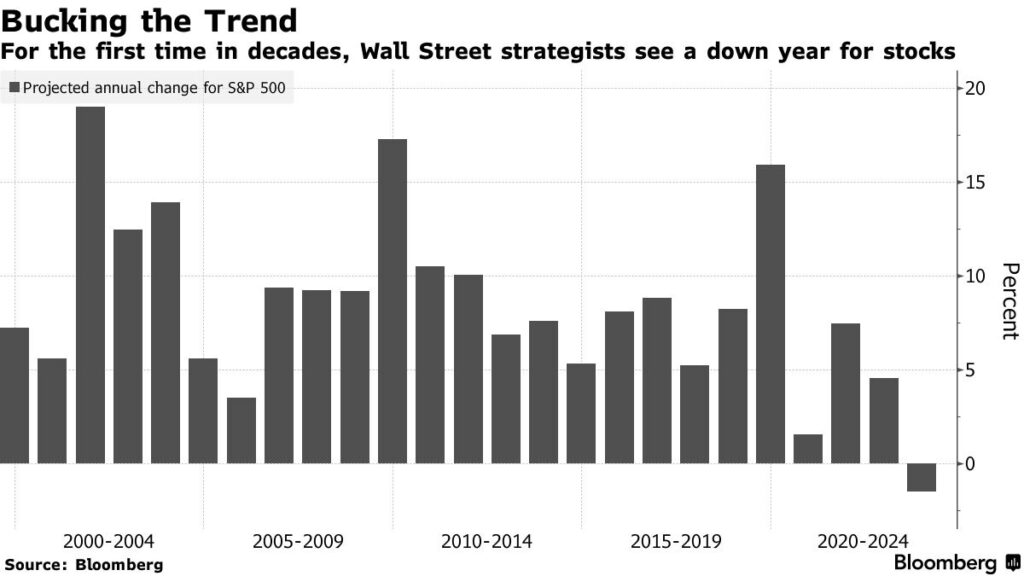

Of course, this is in stark contrast to what the best analysts in the world predicted this time last year. Bob Seawright compiled his annual Forecasting Follies and, as my teenagers might say, he “kept the receipts” for what everyone predicted. He details all of the wrong predictions he could find and there were plenty! It is worth reading the whole collection, but they can be summed up in the chart below. At the start of 2023, the average Wall Street analyst predicted a down year for US stocks, the first time in decades, according to Bloomberg.

“You Should Be Happy”

Like anywhere on the internet, you don’t have to travel far into the comments section of Mythical Kitchen’s “Last Meal” episodes to find some opinions. One that stood out was, “Well, you should be happy; you’re rich!” I hope Tom Hanks isn’t reading the comments section.

Last year’s impressive market rebound was justified: low unemployment, sustainable inflation, healthy corporate profit margins, steady interest rates, and a stable housing market. But the majority of Americans are still not happy with the economy. The Brookings Institute’s recent article by Ben Harris and Aaron Sojourner suggests that Americans should be happier with the economy, and furthermore, what they are reading could explain the disconnect.

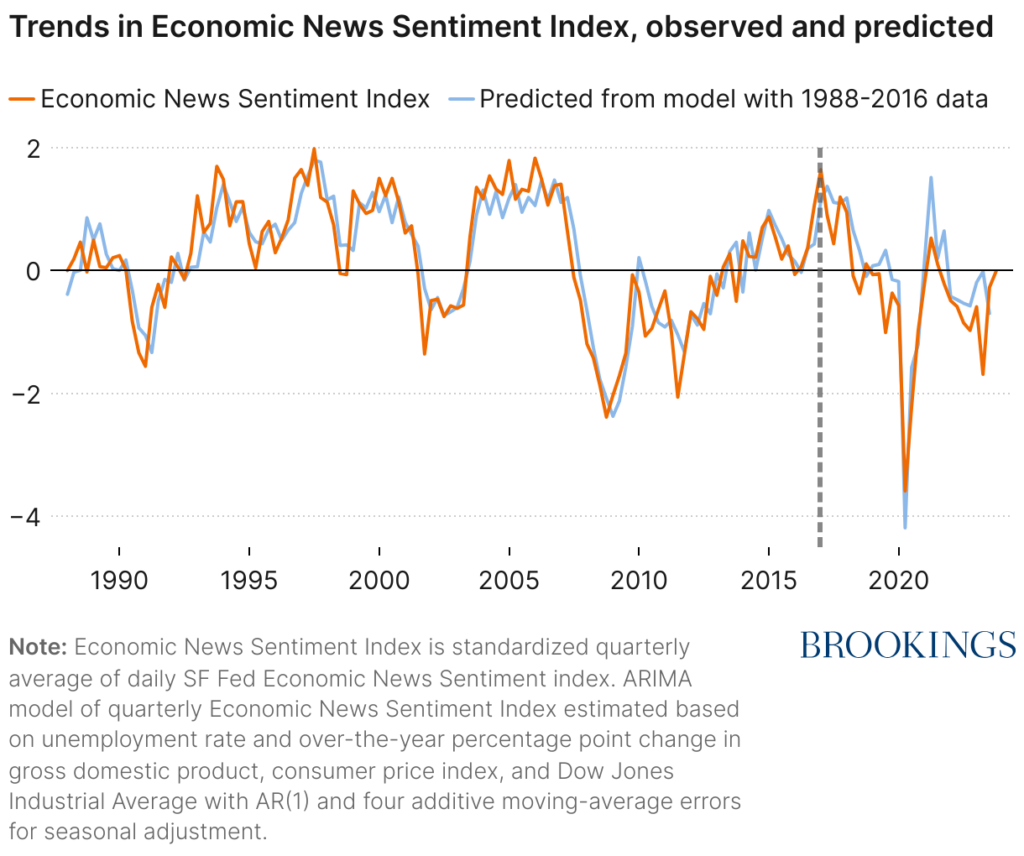

Harris and Sojourner point out that the periods where the actual sentiment of the crowd (orange) is above what their model would predict (blue) correlate to times when Americans were more optimistic than the model might suggest. Unsurprisingly, those times tended to be when markets were high. However, since 2018, we’ve all been a part of a dramatic shift in sentiment. When the data suggested that the economy was on the upswing in 2020-2021, Americans didn’t believe it. And that pessimism continued into the recent quarter. Harris and Sojourner tie this directly back to a shift in media (specifically financial media.) The news has been much more negative, cautious, and fearful than the models would suggest. No wonder this feels like a period of Happy Adjacent.

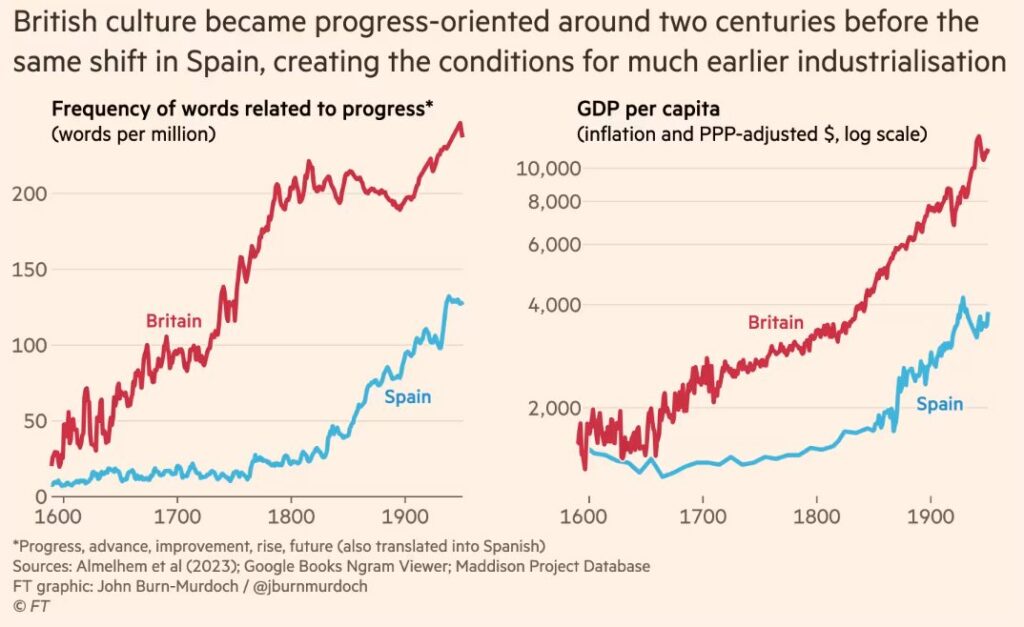

The above charts look at the last 36 years. But what if we looked at a longer time period? John Burn-Murdoch, Chief Data Reporter for the Financial Times, recently summarized the work of economic historian Joel Mokyr and a group of researchers who studied nearly 200,000 books written over the last 400 years. The study found that, as the prevailing tone of writing turned more to “progress and the future,” those economies experienced strong GDP in the coming decades. For instance, we can see that Britain doubled the use of “progress” words from the mid 1700’s to 1800 and then we see a dramatic rise in GDP starting in the early 1800s.

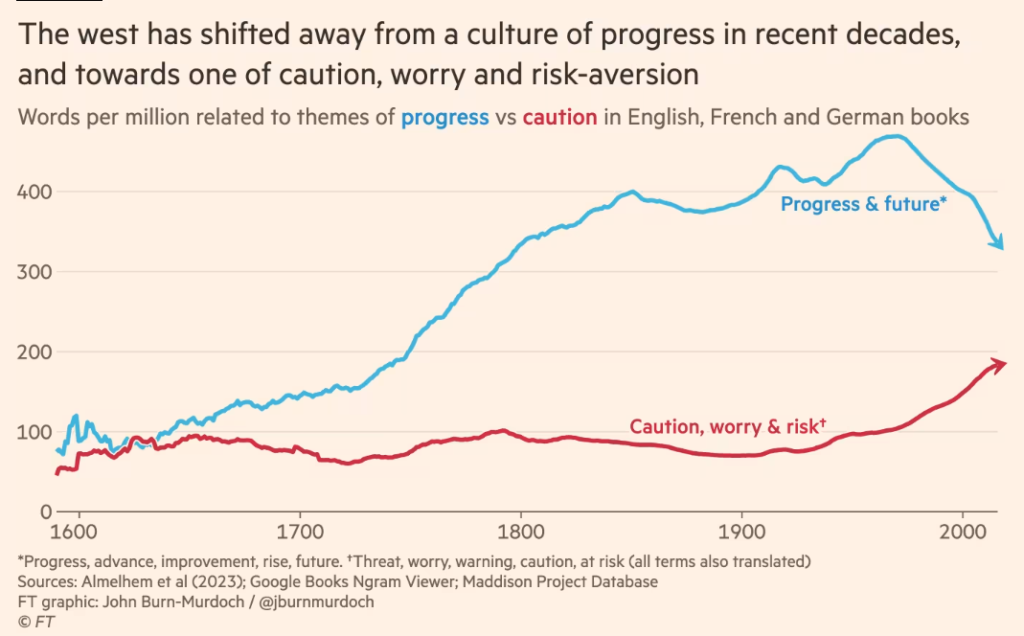

Burn-Murdoch expanded on the research to analyze millions of books and found something interesting. He studied not only the prevalence of words related to “progress and the future” but he also looked at words associated with “caution, fear, and risk.” He found the use of “progress and future” has dwindled to levels not seen since the early 1800s. He also found that we see “caution, worry, and risk” at unprecedented levels.

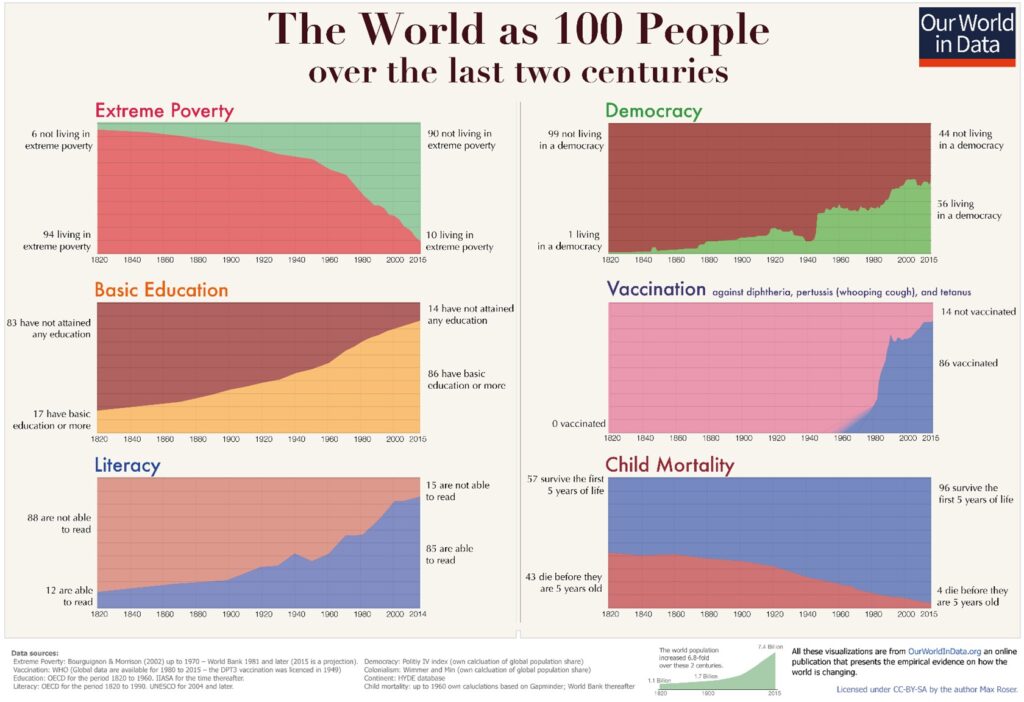

One might conclude that the chart above makes no sense when viewed through the lens of unprecedented improvement in the human experience during these 400 years. As Our World in Data showed in 2016 (below), the average human has seen amazing progress over the last 200 years. Could it be that attaining “progress” has made us more “cautious” about losing it? And in doing so, have we traded in “happy” for “happy adjacent?”

Combating “Happy Adjacent” with “Contentment”

I think Tom Hanks was on to something when he answered that he wasn’t happy, but that he was content. That doesn’t mean he rejects new scripts, but I bet he is more selective. Sure, it is easy to say that $400-500 million in lifetime earnings could give Tom that perspective. But we’ve all seen examples of people with abundant wealth who are discontent. In fact, you and I could be on that list. The World Inequity Database provides a quick tool to let you know where you are in terms of income or net worth compared with other Americans and the world. A couple with a net worth of $500,000 is in the top 22% in the US and the top 5% worldwide. That same couple with a $1,000,000 net worth is in the top 11% in the US and the top 3% in the world.

I don’t write the above to sound like a YouTube commenter (“You should be happy, you’re rich!”). We’ve been in the financial planning and investment arena long enough to know that happiness or contentment rarely comes from having an absolute dollar amount. A Harvard study of over 4,000 millionaires found that happiness did not increase as respondents’ net worth increased from $1.5 million to $7 million. In fact, the slight uptick at the $8-10 million range was only half the “happiness” attributable to being married. Ultimately, how “adjacent” we are to happiness depends much more on how we would answer those “last meal” questions than our net worth.