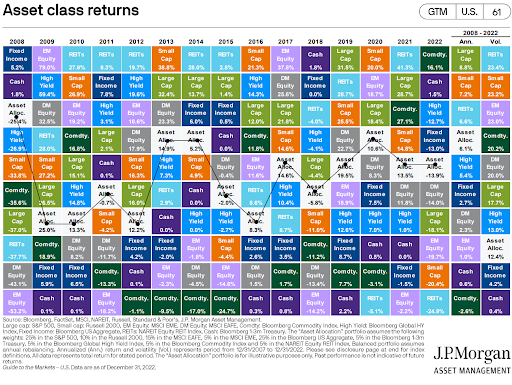

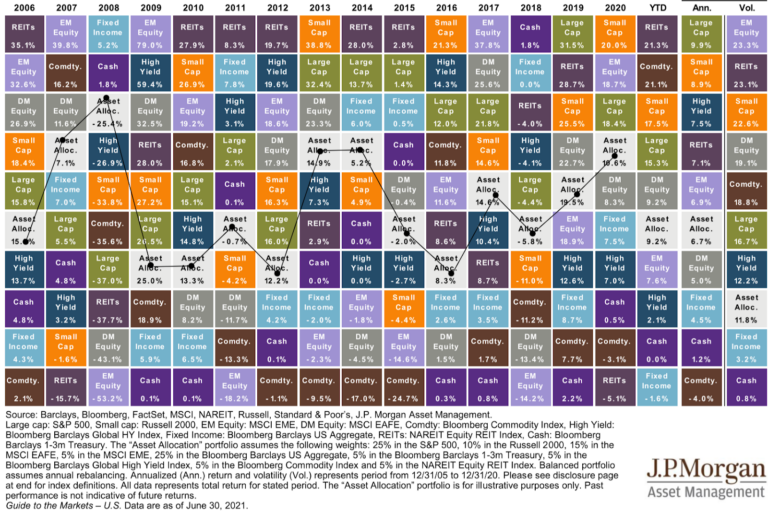

Over the last few weeks, I kept the kids up far past their bedtimes to witness Aaron Judge break the American League single-season home run record. While we had to sit through a whole lot of walks, we eventually got to witness a once-in-a-lifetime event that we’ll tell some grandkids about. Sadly, this year, investors have also witnessed an investment market for the record books. Through the charts below (and a recounting of my real-world experience with our 15-year-old new driver) we’ll examine the year so far, talk through viewing investments through the “windshield” of a financial plan, and see how investors have typically fared better than average coming out of historic times like these.